Solutions To invest in

Solutions To invest in

Blog Article

Overview

The Housing and Improvement Board (HDB) is Singapore's public housing authority, to blame for furnishing affordable housing choices to its citizens. 1 well-liked method of owning an HDB flat is through the use of a possibility to invest in (OTP). An OTP is usually a authorized document that grants the buyer the exclusive ideal to invest in a certain HDB flat in a specified time period.

Purpose of the OTP

An OTP serves various needs in the entire process of buying an HDB flat:

Exclusive Suitable: By acquiring an OTP, the buyer makes certain that no other particular person can buy the specific HDB flat in the validity period of time stated in the choice.

Time for Selection-Creating: The validity interval makes it possible for sufficient time for potential buyers To guage their financial condition, assess eligibility and suitability, and request tips prior to committing to invest in.

Versatility: The customer has versatility in the validity time period as they might make a decision whether or not to exercising their option determined by changing conditions such as bank loan acceptance or preferential place tender effects.

Steps Associated with Getting an OTP

To acquire an OTP for acquiring an HDB flat, various steps have to be adopted:

Decide on a Flat: Settle on the desired site, type, dimension, and selling price range of your favored HDB flat.

Check out Eligibility: Make sure you meet all eligibility requirements set by HDB pertaining to citizenship position, family nucleus composition, age specifications, cash flow ceiling boundaries, and many others.

Submit an application for Loan Approval In Principle (AIP): It is essential to apply for AIP from banking institutions or economic institutions just before making use of for an OTP as this will help establish your utmost financial loan total based upon your economical potential.

Post Application for Oct & Await read more Final results: Soon after getting AIP approval from banks/financial establishments; post on the web application via e-Service portal called "Gross sales Start".

Obtain Providing Letter: In case your software is prosperous, you may obtain an offering letter from HDB with Guidance on how to guide an appointment and proceed to acquire the OTP.

Ebook Appointment & Total Scheduling of Flat: E book an appointment at a specified HDB Hub department to finish the necessary paperwork, make payments, and accumulate the OTP document.

Vital Stipulations in an OTP

When getting an OTP for acquiring an HDB flat, there are many vital stipulations outlined in the doc:

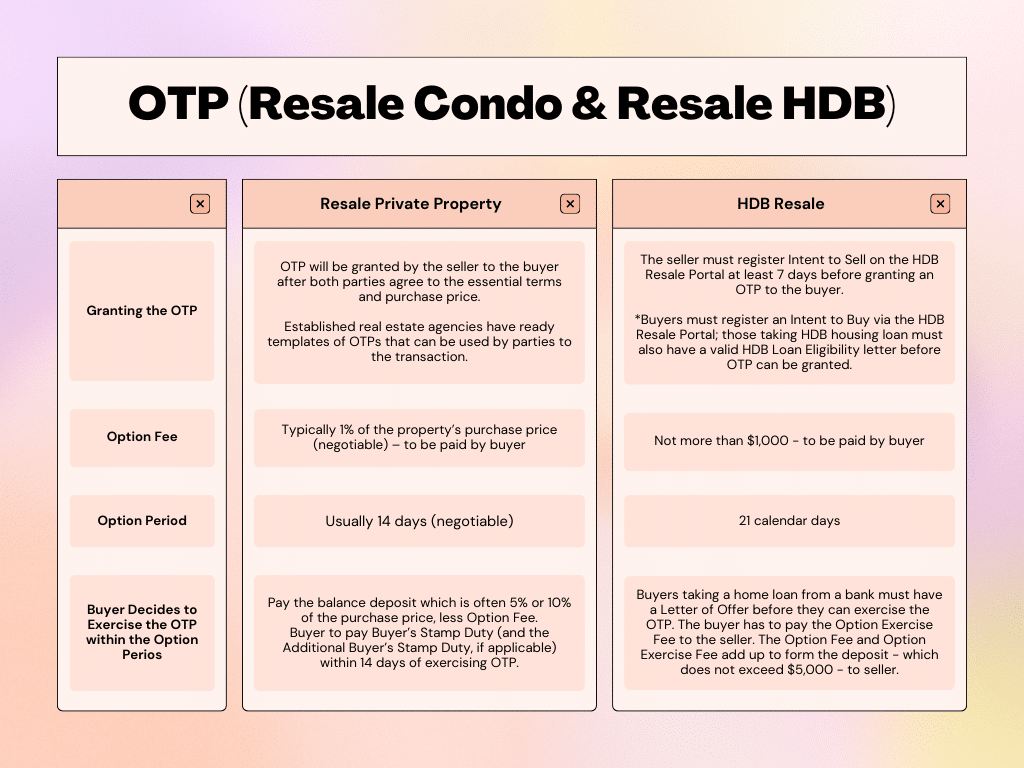

Validity Period: The period of time inside which the customer can choose if to workout their option and carry on with the purchase.

Invest in Value: The agreed-on cost involving the buyer and seller with the HDB flat.

Alternative Rate: A partial payment made by the client as thing to consider for obtaining exceptional legal rights below the choice.

Exercise Payment: Yet another fee payable by the client when training their choice to get throughout the validity period.

Working out or Allowing Go of a possibility

Within the validity time period said from the OTP, buyers have two alternatives:

Performing exercises Possibility:

Paying any stability downpayment essential (commonly twenty% of order price).

Confirming financing arrangements having a financial institution or fiscal establishment.

Accumulating keys to new flat on completion of all authorized procedures.

Continuing As outlined by HDB's pointers for resale flats or Establish-to-Get (BTO) flats.

Permitting Go of Possibility:

Forfeiting any fees compensated during scheduling: option fee, exercise fee, etc.

Allowing others thinking about purchasing that particular HDB flat during remaining gross sales start/application periods.

It's important for potential buyers to remember that failing to training their selection by not finishing requisite steps within just its validity interval may well lead to them to lose the choice fees forfeit in its entirety.

Summary

The Option to Purchase (OTP) is a significant document in the process of paying for an HDB flat. It provides purchasers with special legal rights, time for choice-making, and suppleness just before confirming their purchase. Knowledge the methods involved, critical terms and conditions, and probable outcomes when exercising or allowing go of an option is important for individuals looking at HDB ownership.